It's good to have mentors specially if you are a newbie in financial investing. Reading is one of the sure-fire ways to keep those information running. Noteworthy to mention that while one needs money to invest, another equally important chunk is what we call INFORMATION. And Financial Literacy is all about that.

Randell Tiongson is the author of our book for today. He's also part of Registered Financial Planner (RFP) of the Philippines. During summer of 2013, I embarked myself into another financial literacy journey and all I can say is: it's worth it.

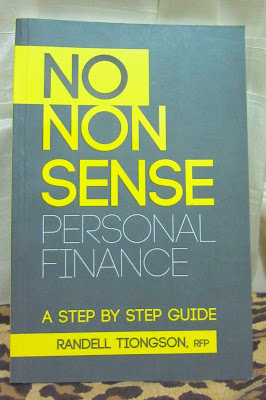

He recently launched a book that details a step by step guide on personal finance. Reduced into 5-easy steps, this gem will jump start your plans and eventually, your actual steps on how to better your financial life.

DETAILS:

NO NON SENSE PERSONAL FINANCE

Publisher: YOUnique Publishing Philippines

Available at: All major bookstores

Price: Php 499 (approx) | Got the book from HERE

There is a risk.

Beyond this 'thing' being proportional, one has to be mindful that in investment, there is an element of risk. An uncertainty. That your money can be in bloom or doom. That is why we attached another word to risk to make it sound less scary. CALCULATED RISK. Yes, that's the name. We take risks, but well-informed one. Chances are, it {the returns} would be worth the risk.

High Risk. High Return.

If you want a higher yield for your buck, higher risk is also involved. It usually is in terms of equity {stock market} investments. Low risks, on the other hand, generates low return. Just look at the tiny interest income on your bank passbooks. Now, there is no right or wrong risk preference, but rather - it's a question of what amount of risk can a person be willing to take.

Master your finances before it masters you.

And that's just the way it is. You have to control your spending before it controls you. Tricky part is - this process is so subtle that you don't notice it at all. It's just that one day - you'll wake up with a reality that your financial life is in chaos. To arrest that fall, ALLOCATION is important. It is simply telling your money where to go.

Whether you use the 70.30 rule (spend 70%, save 30% of your income) or 70.20.10 rule (spend 70%, save 20%, tithes 10%) - bottom line is you are aware where your money is going. Sometimes, it's easy to take for granted minute details like these, but if you'll think long term (like that dream Europe trip) - you'll find a boost of inspiration and do these simple steps as early as now.

A sneak peek of the famous 5 steps.

Book talks about cash flows and getting out of debt. It also tackles the need to setup an emergency fund. Take it from the expert that an insurance is also an integral part of a well-rounded financial planning. Finally, one has to think of ways to invest in his future.

Let's face the music: you are planning because you have a money "to organize" in the first place. Sadly, people with hand-to-mouth lifestyle can't afford to do financial planning, that said - insurance comes into the picture. I once thought that insurance was not important and a waste of money.

After reading and listening to credible speakers {with an open mind}, I realized that insurance gives you some form of protection and your coverage can be withdrawn in full when the need arises. Single people should think about getting critical illness plans, while married people of course should take into account life insurance coverage so that - just in case they crossed the other side, they'll be at peace knowing their loved ones are financially sturdy. But again - this topic is a case to case basis. No right and wrong answers :)

Select {well} and Diversify.

The literature highlights the importance of selecting the right kind of investments and diversification. Sound financial tip always include diversification. Since there's an element of risk - people should not yank their money into one investment product. There's no 100% return in a real investment world. If someone promises you that - chances are, it's a scam.

Be the man with a master plan. Do your homework and research. Be informed enough to know where should you put your money and while your money is there - you can still sleep well at night. That's very important.

When all has been done and dusted, you ask yourself : NOW WHAT?

Armed with goals and know-hows, suppose that you got all you want. Your investments are doing well. You accomplished your financial goals. Next sensible thing to ask is NOW WHAT? It's not to say that gathering money is futile, but a good question to ponder is: WHO AM I WHEN ALL MY MONEY HAS BEEN TAKEN AWAY FROM ME?

God bless you on your journey towards a financially-rewarding life. But include GOD in your plans and actions - that would be a great combination. -CMK

No comments

Post a Comment